Article by Derek Brainard, AFC®

Strategies for defending your hard-earned savings from inflation, taxes, and fees

You have dreams. We all do! We want to retire with dignity, see the world, spend more time with family, maybe even buy some toys. It’s no secret that living the life you want in retirement is going to cost you. While social security is great for those that have it, the current version of social security may look very different for millennial investors when the time comes to tap into this benefit, so informed investing has become that much more important. We will come to rely heavily on our investment assets (mutual funds primarily with some real estate here and there for those so inclined) to fill the income gap in our golden years. That said, the return we achieve over time matters. We can go on the offensive by actively contributing funds to our investment accounts each and every month, but to truly maximize long-term returns playing both offense and defense as investors is crucial. This is especially true given the complexity of the industry as well as external “return-reducers.” Three of these silent killers are (surprise, surprise) inflation, taxes, and fees.

But before we get to these three big reducers, consider this…

You’ve built up a beginner nest egg of $50,000 and are hoping this amount continues to grow along with your monthly contributions to achieve your ultimate amount needed at retirement. One day you find a compound savings calculator on your bank’s website and are curious to see what that $50,000 by itself could grow to at an average annual return of 7% for the next 20 years.

Side-note – you may be asking yourself “what does average annual return” really represent? It means some years you’ll earn much more on your investments, some years less, and some years you’ll want to throw your laptop through the kitchen window, but the average of all returns over a long period yield this percentage. Remember, there are no guarantees in investing, but projecting this way can at least give us an idea of where to start as we develop our financial plans. Now, back to our story:

Using the online calculator, you do the math and figure that your investment could end up somewhere in the ballpark of $193,400 if all goes according to your strategy. While you intend to add more each month, you figure “not a bad start!” Unfortunately, the “return-reducers” mentioned above have other plans for your hard-earned savings.

Inflation

Inflation is the general increase in prices of things we buy every day – groceries, housing costs, clothes, etc.…The increase in the cost of this “basket of goods” over the past few years has hovered around 2% (read more about inflation and the Consumer Price Index). This increase impacts what is called our “buying power”, meaning our dollar today buys 2% less that it did a year ago. To adjust our projected 7% return for inflation, we use the following formula: ((1.07/1.02)-1) x 100

Using this formula, our new inflation-adjusted rate of return is 4.9%. That means that while our 50k investment technically could grow to 193k over 20 years, it will only have the purchasing power of a little over 130k. That may not seem like a big deal now, but if you need 193k to truly live comfortably in retirement this means you’ll have to save more to achieve the same buying “umph”.

The defensive play: Include growth-oriented mutual funds in your portfolio mix that help you stay ahead of inflation over the long-term.

Fees

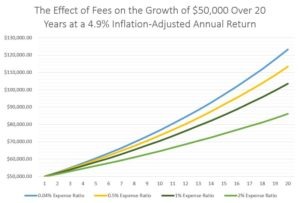

Fees on mutual funds have been a hot topic since before Jack Bogle created the index fund, and for good reason. Once investors began to see that they could use lower-cost index funds and exchange-traded funds (ETFs) to get returns just as good as, if not better than their more actively managed counterparts, price wars broke out between major online brokers. Because most index funds mirroring the same index serve essentially the same function, they are forced to compete partly on price, driving expense ratios down at or very near zero percent. Of the top 20 most popular funds of 2019 (by volume of inflows), 13 were ETFs with an average expense ratio of 0.14%. There is a clear demand for low-cost solutions because it’s no secret that fees can be a major drag on investment performance. While this doesn’t necessarily mean that you should never spring for an actively managed fund with good management, fundamentals, and track record, it does mean that we should have both eyes wide open when deciding to what fee structure we’re committing to.

The most common fees paid on mutual funds are loads and expense ratios. Loads are fees investors pay when they buy or sell mutual fund shares, depending on what share-class they are using. These are comparable to sales commissions and can be as high as 5-6% of the amount being invested, so the lower the load the more money gets to work for you sooner. There are funds that do not charge loads (called no-load funds) but these can still charge other fees for the purchase, so read the fine print.

The expense ratio represents the ongoing cost to cover the expenses of the mutual fund itself and includes fees to pay fund management, fund marketing and distribution costs (aka 12b-1 fees), account maintenance, and more. The tricky thing about these costs is that they’re paid out of the fund’s assets themselves and aren’t billed directly to investors the way loads and sales charges are. To find the true costs we can check out the operating expenses section of the fund’s prospectus and note the net expense ratio from analyst reports through Morningstar, Yahoo Finance, or your site of choice. Expense ratios can range anywhere from zero percent for self-indexing funds to over two percent for more actively-managed specialty funds. These percentages may not sound like much, but don’t take my word for it – just check out the Security and Exchange Commission’s Investor Bulletin on how fees and expenses affect a $100,000 investment over 20 years. If we apply the same analysis to our 50k example using the inflation-adjusted return we came up with earlier, it would look something like this:

The defensive play: Look into what you’re paying for your current portfolio across all loads and expense ratios. Ask your financial planner how they get paid and for a list of all the costs associated with your investments. As always, you can diversify your approach by owning both actively and passively-managed funds – track your performance across these holdings over time both in growth and in downside protection to inform your re-balancing decisions.

Taxes

No shocker here. We all have to pay the tax-man on the income we earn and the income that comes from our investment accounts in one way or another. However, our total tax bill depends on whether we pay taxes on our contributions before they are invested or as they are withdrawn. If you invest in traditional employer-sponsored plan like a 401(k) or 403(b) and/or a Traditional IRA, your contributions are deductible from your taxable income in the year you invested (up to certain income thresholds which are announced by the IRS each year). This means more of your money goes to work for you sooner, but you will pay taxes on all of your withdrawals down the road in retirement at whichever income tax bracket you are in at the time. On the other hand, Roth contributions to either employer-sponsored plans or a Roth IRA mean you go ahead and pay taxes on your contributions up-front, then invest the money. The upside? All qualified withdrawals in retirement (including the growth on your investments) are tax-free. Good deal! If you max out these types of investing accounts based on annual contribution limits, you can always go back to funding a taxable brokerage account, but all dividends and capital gains distributions will be taxed in this account each year, and there is no tax-deferment benefit.

The defensive play: Diversify your tax approach in-line with your long-term goals. You can use both traditional and Roth contributions for IRAs and 401(k)s – in fact, if your employer offers a match these funds will go into your account as traditional contributions even if you elect the Roth option for your own contributions. Talk to your financial planner and CPA about the benefits or drawbacks of each strategy.

How Did Our $50,000 End Up?

So after all that, how did we end up in 20 years? After accounting for inflation and fees, our $50,000 might grow to have a purchasing power value of $86,000 if we use a higher-load mutual fund or climb as high as $123,000 if we choose a lower-cost option (either way, a far-cry from the $193,400 we originally calculated). If our contributions were after-tax Roth contributions, then this is what we walk away with at the end of the day. If we used tax-deferred traditional accounts, then taxes will take their toll from here as we move through retirement.

The good news? Knowing about these silent killers up front will help you ramp up your defense earlier in the game. Consider the strategies laid out here to adjust your monthly savings goals and take advantage of tax-favored accounts and lower-cost funds where they can fit into your plan.

Now that we know our top “return-reducers” by name it’s time to get serious about making choices to reduce the damaging effect of inflation, taxes, and fees.

In the end, a best offense always includes a good defense.

Referenced in this article:

Inflation vs. Consumer Price Index (CPI), How They Are Different

Top inflows of 2018How Fees and Expense Affect Your Investment Portfolio

About Derek Brainard

About Derek Brainard

Derek Brainard is an Accredited Financial Counselor® and Manager, Education Services at AccessLex Institute’s Center for Education and Financial Capability. Derek has worked in both the private financial services sector as a licensed financial advisor, and in higher education as financial literacy coordinator at Syracuse University. His financial writing and commentary have been featured via U.S. News and World Report, MSN Money, and USA Today.